A Provision of the Federal Tax Code Reducing the Taxes for Low-income Families With Job Earnings.

The earned income tax credit (EITC), outset proposed in the early 1970s, was signed past President Ford. It was later substantially expanded by President Reagan, who deemed information technology "the best anti-poverty, the best pro-family, the best job creation measure to come out of Congress" (Snyder 1995). Yet, in recent years, the EITC has often come nether political assault. It is criticized (sometimes implicitly simply often explicitly) because it eliminates the income tax liability of many low-income workers, thus, information technology is claimed, giving them no "skin in the game" in support of the common good.1 Others criticize it for redistributing income to "people who have never paid a dime in their lives" simply still "get a bank check from the government" (Sandmeyer 2013).

Recent expansions of the EITC and the child tax credit (CTC) will phase out in 2017. Further, recent discussions about wide-based tax reform accept focused much attending on eliminating or scaling back tax expenditures—special tax rates, deductions, exclusions, exemptions, and credits (ofttimes called loopholes), including the EITC and CTC, that reduce revenue enhancement liability. Given this, and given past criticisms of these revenue enhancement credits targeted to low- and moderate-income taxpayers, information technology is useful to review the history, purpose, and goals of the EITC and CTC, as well as the enquiry on the credits' effectiveness in meeting these goals. This brief does and so; its chief findings are:

- Both the EITC and the CTC were initially proposed, supported, and expanded past Republican policymakers with wide bipartisan support.

- Challenge the EITC and CTC can be complicated and involves filing additional tax forms, which leads to errors of both over- and underpayment.

- The EITC appears to increment the labor force participation of single mothers, yet the high marginal tax rates associated with its phase-out range do not appear to take a meaning work disincentive consequence.

- The EITC is, by far, the nigh progressive tax expenditure in the income taxation code.

- The EITC reduces poverty significantly, with children constituting half of the individuals information technology lifts out of poverty.

- The EITC and CTC are effective in increasing after-tax income of targeted groups, reducing poverty, and reducing income inequality.

Description

The primary purpose of taxes is to fund government to meet diverse social and economical goals regarding national security, economic stability, income distribution, poverty alleviation, and the efficient resource allotment of resources. The activities directed to lower-income individuals and families typically involve grants or transfer payments, which are often ways-tested. Means-tested grants are fairly effective in reducing poverty merely tin can potentially create work disincentive furnishings.

Tax expenditures are also ofttimes used to come across many of the aforementioned social and economic goals.2 Overall, taxation expenditures do good taxpayers at all income levels, only they raise the after-tax income of higher-income taxpayers more than that of lower-income taxpayers (see, for case, Toder and Baneman 2012).

The earned income tax credit (EITC) and the child tax credit (CTC) are two tax provisions targeted to low- and moderate-income taxpayers. The EITC encourages work among low-income individuals. Both the EITC and the CTC significantly reduce taxes on depression- and middle-income families with children.

Tax credits differ from other revenue enhancement expenditures in that they straight reduce income tax liability, rather than indirectly through reducing taxable income. That is, $ane of a tax credit reduces tax liability past $ane. A tax deduction of $1 will reduce taxable income by $ane, but reduces tax liability by the marginal tax rate times $1. For case, an additional $1 of deduction for a taxpayer in the 10 percent revenue enhancement bracket reduces tax liability past 10 cents; a taxpayer in the 39.6 percent tax bracket would take her revenue enhancement liability reduced past 39.half dozen cents.

The EITC and CTC differ from about other tax credits in that they are partially or fully refundable. With a refundable tax credit, if a taxpayer were to have $100 in tax liability and $200 in a refundable taxation credit, then he would receive a tax refund of $100.three The EITC and CTC are similar in that the amount of the credit depends on the number of qualifying children and earned income.

Earned income taxation credit

The EITC was enacted during the Ford assistants past the Tax Reduction Deed of 1975. Originally, the EITC was supposed to be a temporary refundable revenue enhancement credit for lower-income workers to offset the Social Security payroll tax and rising food and energy prices. The credit was made permanent by the Revenue Act of 1978. The EITC was considered both an anti-poverty program and an alternative to welfare considering it incentivized work (Ventry 2000).

The EITC grew out of the 1960s debates over the negative income tax (NIT) and the early 1970s debate over the Nixon administration'southward Family Assistance Plan (FAP).4 Both the NIT and FAP would have operated through the income tax arrangement to provide an income floor. Congressional opposition (primarily from Sen. Russell Long) and opposition from the National Welfare Rights System (NWRO) substantially "zapped" FAP and the idea of a negative income tax as a replacement for the welfare arrangement.v

The EITC has changed since it was first enacted in 1975. The Tax Reform Act of 1986, signed past President Reagan, indexed the maximum earned income and stage-out income levels to aggrandizement. Congress has farther made it more generous, with the maximum credit for a worker with iii children increasing from $400 in 1978 (about $1,400 in 2012 dollars) to $5,891 in 2012. Low-income workers with no children are also eligible for the EITC, but the maximum credit ($475 in 2012) is but a small-scale fraction of that for families with children. (See Tabular array one for the 2012 EITC parameters.)

Parameters of the EITC, 2012

| No children | One child | Two children | Iii children | |

|---|---|---|---|---|

| Maximum credit | $475 | $3,169 | $5,236 | $5,891 |

| Credit rate | 7.65% | 34% | 40% | 45% |

| Stage-out rate | 7.65% | xv.98% | 21.06% | 21.06% |

| Income where EITC=0 | ||||

| Unmarried | $13,980 | $36,920 | $41,952 | $45,060 |

| Married | $xix,190 | $42,130 | $47,162 | $50,270 |

Source: Internal Revenue Service (2011)

Copy the lawmaking beneath to embed this chart on your website.

The EITC is work-oriented in that the amount of the credit is based on earnings. Earnings include wages and salaries as well as self-employment income, but do not include income that is not continued with employment (e.g., interest, dividends, capital gains, and income from social welfare programs). The amount of the credit first increases as earnings increment, reaches a plateau, and so falls as earnings increase. For example, for a couple with ii children (meet the third data column in Tabular array 1), the credit is equal to 40 percentage (the credit rate) of the showtime $thirteen,090 in earnings. The maximum credit of $5,236 is received by taxpayers with earnings between $13,090 and $22,300. The credit phases out at a charge per unit of 21.06 percent (that is, it is reduced by 21.06 cents for every additional dollar of earnings) for earnings over $22,300 and is null for taxpayers with earnings over $47,162.

Kid tax credit

The kid tax credit was enacted as part of the Taxpayer Relief Act of 1997 as a $400-per-child credit (which increased to $500 for taxation years after 1998) and accounted for over threescore percent of the x-year cost of the entire beak (Joint Commission on Taxation 1997). The origin of the credit can be traced to a proposal for a $one,000-per-child tax credit by the 1990 National Commission on Children (1991). A less generous credit ($500 per kid) was proposed by the House Republicans of the 104th Congress in the 1994 "Contract with America" (Steuerle 2004); this lower corporeality was the basis for the tax credit created three years later. The child taxation credit had broad bipartisan back up. Information technology was somewhen increased to $one,000 per child as part of the 2001 and 2003 Bush tax cuts.

The credit was adopted because Congress believed that the personal exemptions for dependents ($2,550 in 1996) did not "reduce tax liability by enough to reverberate a family unit'south reduced ability to pay taxes as family size increases" (Articulation Committee on Taxation 1997, 6). Although the dependent exemption has been indexed to inflation since 1985, the real value of dependent exemptions was $five,716 (2012 dollars) in 1950, compared with the 2012 dependent exemption of $3,800. (Even so, the value of dependent exemptions in 2012 is approximately what it was in 1996 when the latter is adapted for aggrandizement.)

The CTC allows a nonrefundable credit against income taxes (including the culling minimum taxation) of $1,000 per qualifying kid under age 17. The credit begins to phase out for married taxpayers with adjusted gross income (AGI) above $110,000 ($75,000 for single taxpayers) at a rate of $50 for each $1,000 that AGI exceeds the threshold.

The credit is partially refundable (the refundable portion is chosen the additional child tax credit). To the extent that earned income exceeds a given income threshold ($3,000 in 2012) and the nonrefundable credit exceeds tax liability, an amount of up to 15 percent of the excess earnings (with a maximum of $1,000 per child) is refundable.

Unlike the EITC, the child tax credit is not targeted to but lower-income taxpayers. A married couple with two qualifying children tin can receive the child taxation credit with AGI up to $150,000 (an income level that puts them in the top 10 percent of the income distribution). In fact, the limits on the additional child revenue enhancement credit cap the refundable portion of the credit for the lowest-income taxpayers, but usually not for heart-income taxpayers. In addition, the CTC is a fixed per kid amount and thus does not take into consideration economies of scale inside the family.

Other provisions related to work or children

Historically, the federal income taxation organization has related tax liability to family size. Other major family-related tax provisions are:

- the exemption for dependents (in the tax code since 1917)

- the different taxation bracket thresholds depending on marital/filing condition (in the taxation code since 1948)

- caput of household filing condition (in the tax code since 1951)

- the child and dependent care tax credit (in the tax code since 1976)

These provisions are available to taxpayers at all income levels, only the benefits of some may exist limited for the highest-income taxpayers past other tax provisions. The beginning 3 provisions are considered office of the normal income tax organization and, therefore, are non considered taxation expenditures. Furthermore, these iii practice non depend on the taxpayer'southward employment status or on earnings. The last provision, the child and dependent care tax credit, is contingent on employment and earnings, and is considered a tax expenditure.

Exemptions for the taxpayer have been in the tax code since the get-go of the individual income tax. The boosted exemption for dependent children was added by the Revenue Act of 1917 ($200 for each dependent under age eighteen). Taxpayers are allowed exemptions for themselves and dependents ($iii,800 per personal exemption in 2012) in calculating taxable income. Exemptions do not affect tax liability in the same way that tax credits practise. Instead, exemptions reduce taxable income, and their consequence on tax liability depends on the taxpayer'due south revenue enhancement bracket. For example, a taxpayer in the ten percent tax bracket receives a $380 tax reduction for each personal exemption, whereas a taxpayer in the 25 percent taxation subclass receives a $950 tax reduction per personal exemption.half-dozen Personal exemptions combined with the standard deduction protect a minimal amount of income from taxation, ofttimes eliminating income revenue enhancement liability for many lower-income individuals and families.

Since 1976, working taxpayers take been able to claim a nonrefundable tax credit for employment-related intendance expenses for children and other dependents. The maximum credit is 35 percent (the credit rate) of $3,000 for 1 qualifying child ($i,050) and of $vi,000 for two or more qualifying children ($2,100). The credit rate is reduced every bit AGI rises (the minimum credit rate is twenty percent). About taxpayers claiming the credit receive less than the maximum corporeality of the credit. Since this credit is nonrefundable, working taxpayers with no tax liability cannot claim the credit.

Cost

Both the EITC and CTC reduce the tax liability of eligible taxpayers and, consequently, reduce tax revenue. The Joint Committee on Taxation (2013) estimates that the earned income tax credit reduced federal revenue enhancement revenue by $59.0 billion in fiscal 2012 and volition reduce taxation acquirement past $325.nine billion between fiscal 2013 and 2017 (see Table 2). The forgone tax revenue from the kid tax credit is estimated to have been $56.8 billion in fiscal 2012. In comparison, fiscal 2012 outlays for the main federal family unit assistance program—Temporary Assistance for Needy Families—was $xvi.ane billion, while outlays for nutrient stamps (now chosen the Supplemental Nutrition Aid Program) were $eighty.0 billion. In contrast, forgone tax revenue from two tax provisions primarily benefiting higher-income taxpayers—the exclusion of pension contributions and earnings, and the reduced taxation rates on uppercase gains and dividends—amounted to over $200 billion in fiscal 2012.

Revenue loss estimates of the EITC and CTC (billions of dollars), 2012–2017

| Fiscal twelvemonth | Earned income tax credit | Child tax credit | ||

|---|---|---|---|---|

| Total | Refundable | Total | Refundable | |

| 2012 | $59.0 | $51.4 | $56.eight | $29.vi |

| 2013 | 60.ix | 53.two | 57.three | 30.8 |

| 2014 | 67.0 | 58.0 | 57.nine | 31.2 |

| 2015 | 66.5 | 57.seven | 58.iv | 31.ane |

| 2016 | 66.3 | 57.6 | 58.9 | xxx.vi |

| 2017 | 65.3 | 56.8 | 59.0 | xxx.three |

| 2013–2017 | $325.nine | $283.2 | $291.six | $154.0 |

Source: Articulation Committee on Revenue enhancement (2013)

Copy the code beneath to embed this chart on your website.

Evaluation

Adam Smith's The Wealth of Nations (1776) introduced the convention of evaluating tax provisions on three criteria. The outset is simplicity and convenience—the provision should be conspicuously stated, not capricious, and minimize the inconvenience of filing the tax return. The second criterion is efficiency—the extent to which the provision adds or removes economic distortions. Whether or not a taxation incentive achieves its objective, such as increasing work effort, tin can be considered a question of efficiency. Lastly, a provision should be judged on equity—how the benefit or burden of the provision is distributed among taxpayers, and how information technology changes the distribution of the overall tax burden.

Simplicity and convenience

As Congress has increasingly used the tax code to pursue policy goals, tax returns have become longer and more complex. Taxpayers challenge the EITC and CTC must file either Form 1040 or Form 1040A.vii Form 1040 is a two-page, 77-line revenue enhancement form with a bones instruction booklet of 108 pages.8 The simpler Class 1040A is a two-page, 46-line tax class with a 96-page education booklet. A taxpayer challenge the EITC must file the six-line Schedule EIC (providing information on the qualifying children) with her tax render and calculate the amount of the credit using a six-line worksheet. Claiming the CTC involves filing the 13-line Schedule 8812 (for the boosted kid tax credit) and calculating the credit using a 10-line worksheet. The Internal Revenue Service (IRS) also produces a 60-page publication to explicate the EITC (Publication 596) and an 11-page publication to explicate the CTC (Publication 972).

This paperwork burden entailed in challenge the EITC and the CTC is mitigated somewhat by the use of paid revenue enhancement preparers or volunteer tax preparers, and electronic revenue enhancement return filing. Almost 80 pct of taxpayers filing the 1040 or 1040A filed electronically in 2010, and threescore pct used a paid or volunteer tax preparer (IRS 2012).

In a recent report, the Treasury Inspector General for Tax Administration (2013) noted that 20 percent to 25 percent of EITC payments are improper. Earlier studies have estimated similar improper payment percentages (for example, IRS 2002). However, EITC noncompliance studies accept shown that the near common errors leading to overpayments involve unintentional misreporting of qualifying children (McCubbin 2000; IRS 2002). Furthermore, the noncompliance studies practise not take into account underpayments. McCubbin (2000) cites estimates that up to 20 per centum of eligible taxpayers neglect to claim the EITC. Information technology is easy to understand how these unintentional errors occur. The criteria for qualifying children vary among dissimilar tax provisions. The IRS (2013) has prepared a three-page table listing the qualifying child criteria for the EITC, CTC, dependent exemption, caput of household filing status, and the child and dependent care credit. Nigh taxpayers with children take reward of two or more than of these tax provisions, and defoliation is unavoidable when a child may exist a qualifying child under one provision simply not another.

Efficiency

Taxes and taxation provisions tin can change taxpayer beliefs by introducing incentives or disincentives. The EITC and CTC affect the monetary rewards to working and having children. By affecting the afterwards-taxation wage rate, these tax credits tin impact labor supply or work effort, although the consequence is theoretically ambiguous. A higher after-tax wage (due to, say, a tax reduction) increases the toll of leisure. This would lead an individual to have (or purchase) less leisure, or work more. This is known as the commutation result.ix But a college after-tax wage increases income, which would lead an individual to take more leisure or work less. This is known as the income effect.ten The total effect on labor supply of a change in the after-taxation wage is the sum of the exchange and income effects, which have contrary impacts on labor supply. Consequently, the total effect is ambiguous.

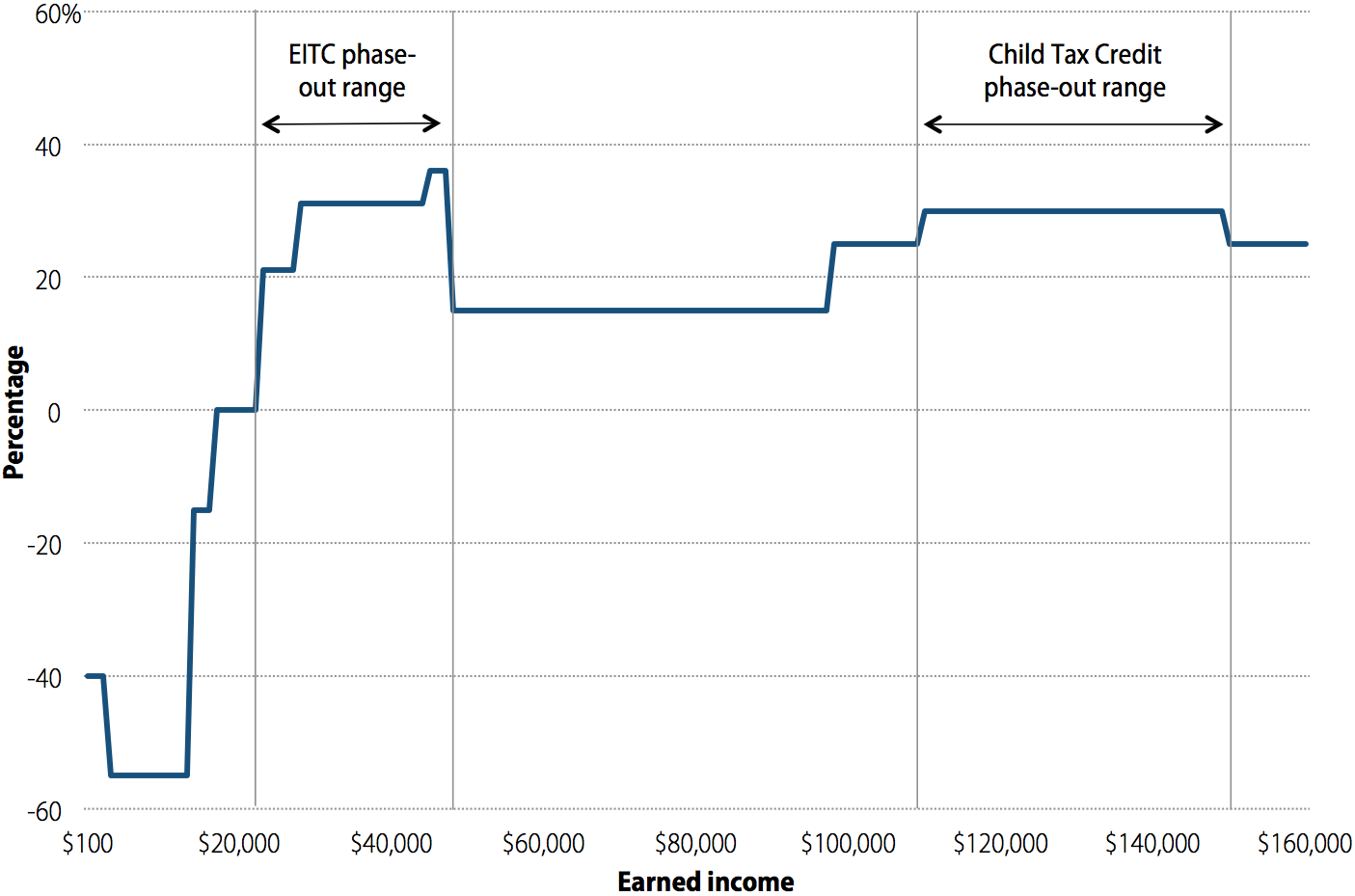

The afterwards-tax wage rate for working one more hour is the hourly wage multiplied by 1 minus the marginal tax rate. For most workers, the marginal income tax rate is either 10 percentage, 15 percent, or 25 percent. Only the EITC and CTC change the marginal revenue enhancement rate that a worker faces. Figure A shows the marginal tax rate of married workers with two children as annual earnings increase. The marginal tax rate varies from minus 55 percentage equally the tax credits phase in to plus 36 per centum as the EITC phases out. In the stage-in range, the subsequently-tax wage is 55 percentage higher than the earlier-tax wage rate, which provides an incentive to increase labor supply (either to brainstorm working or work more than hours). In the stage-out range, the subsequently-tax wage rate is 36 pct lower than the before-revenue enhancement wage rate and provides an incentive to piece of work less (that is, reduce labor supply).

Marginal tax rates of married workers with two children

Source:Authors' assay of NBER Tax Simulator

Re-create the lawmaking below to embed this chart on your website.

Since its inception, numerous studies have examined the labor supply furnishings of the earned income taxation credit (reviewed in Hotz and Scholz 2003; Eissa and Hoynes 2006a; and Meyer 2010). Most studies focus on unmarried mothers and find that the EITC increases labor force participation (that is, induces single mothers to notice a job). But for those already working, at that place is mixed evidence that the EITC significantly affects the number of hours worked. Chetty, Friedman, and Saez (forthcoming) discover that workers with children increase their hours of work in the EITC phase-in range, only do not substantially alter their hours in the phase-out range. This suggests that the high marginal revenue enhancement rates associated with the EITC phase out have limited work disincentive effects.

A few studies examine the EITC and the labor supply of married taxpayers. Since the EITC depends on family earnings, the EITC could take unlike effects on the primary wage earner and the secondary wage earner.11 Among married women who are already working, the EITC appears to accept little effect on labor force participation (in the phase-in range) and a modest negative effect on the hours worked (in the phase-out range) (Eissa and Hoynes 2006b; Heim 2010).

Overall, this research indicates that the EITC has a positive labor supply effect; it increases labor force participation with little or no consequence on hours worked. The high marginal tax charge per unit in the EITC stage-out range has no apparent effect on labor supply. This could be due to near taxpayers taking the EITC as a lump-sum tax refund, workers being unaware of the EITC taxation consequences when making labor marketplace decisions, and/or institutional labor marketplace constraints (for instance, work hours are often fixed past the employer).

Additionally, the credits affect the annual taxation savings of a child and thus the "cost" of a child. In theory, the EITC and CTC could affect marriage (through marriage penalties and bonuses) and fertility decisions. Most inquiry that has examined the tax effects on marriage conclude that the taxation credits have non afflicted union patterns (reviewed in Hotz and Scholz 2003). Show suggests that the tax credits, notwithstanding, may have small positive incentive furnishings on fertility (reviewed in Hotz and Scholz 2003).

Disinterestedness: Impact on poverty and income distribution

The 2 tax credits are designed to increase the subsequently-revenue enhancement income of depression- and moderate-income individuals and families, especially those with children. Since the credits redistribute income, they can be judged on their effect on poverty, tax progressivity, and after-tax income inequality.

Impact on poverty

These taxation credits can exist thought of every bit regime transfers, part of which is used to pay income tax liability (the nonrefundable function) and the residual available for consumption or saving (the refundable part). Adding the amount of the EITC and CTC to family income reduced the number of people in poverty past almost vi million in 2011 (according to the authors' assay of March 2012 Current Population Survey information). Over half of the individuals moved above the poverty threshold were children.

The upshot of the two revenue enhancement credits on poverty is non uniform; it varies by family unit size. Adjusting for family size tin can change apparent tax burdens every bit well every bit the tax benefits for the EITC and CTC (see, for example, Hoffman and Seidman 1990; Gravelle and Gravelle 2006; and Cronin, DeFilippes, and Lin 2012). Table 3 reports the before- and afterwards-tax poverty rates of taxpayers receiving the EITC or the CTC, by tax filing status and number of qualifying children.12 On the one hand, taxpayers eligible for the EITC who have no qualifying children accept the highest poverty rates: virtually 78 percent of single taxpayers and 56 pct of married taxpayers in this grouping accept before-tax incomes below the poverty line. The after-tax incomes of these two groups get out even greater percentages in poverty. These after-tax poverty rates undoubtedly would have been higher without the EITC, but for these taxpayers the credit does picayune to offset income and payroll taxes. On the other mitt, taxpayers with qualifying children (married or unmarried) experience a reduction in poverty rates due to the EITC and CTC. For some of these taxpayers, the two credits together more than commencement income and payroll taxes to raise living standards.13

Poverty rates of taxpayers receiving the EITC or CTC, by tax filing status and number of qualifying children

Nautical chart Data Download data

The data below can be saved or copied straight into Excel.

The data underlying the effigy.

Note: Country taxes and income from means-tested public assistance are not included in the analysis.

Source: Authors' assay of IRS (2008)

Copy the code below to embed this chart on your website.

Touch on income distribution

Every bit would be expected given the result on poverty, the revenue enhancement benefits of the credits are progressively distributed, as measured by the Suits index. The Suits alphabetize is a measure out of progressivity that ranges from -1 (completely regressive) to +i (completely progressive). The Suits index is negative if the benefits are predominately received by taxpayers in the upper role of the income distribution. It is positive if the benefits are predominately received by those in the lower office of the distribution. The estimated Suits index for the EITC is 0.87, which is highly progressive (Hungerford 2006). The estimated Suits alphabetize for the child tax credit is 0.28—less progressive than the EITC, merely still progressive (Hungerford 2006).

Bear on on income inequality

The effect on income inequality can be measured past the Gini coefficient, which varies from 0 to 1. A Gini coefficient of 0 indicates that income is evenly distributed among the population (that is, everyone has the same income), while a value of i indicates perfect income inequality (that is, 1 individual has all the income). The EITC reduces the Gini coefficient by 0.34 percentage, and the CTC reduces it by 0.61 percent (Hungerford 2010), indicating that the credits help to reduce income inequality.

Policy options for EITC and CTC reform

A number of different proposals offer recommendations on how the EITC and CTC could be reformed and improved. The proposals try to correct one or more of the credits' undesirable features: complexity, unequal handling based on marital condition, and the high marginal tax rates as the credits phase out. Some of the key provisions to accost the drawbacks of the two credits are discussed. Selected proposals are described beneath, including those put forth by the Economical Policy Found in its budget proposal, Investing in America'south Economy (Bivens et al. 2012a), besides every bit those recommended by various policy groups and included in recent congressional bills.

One vein of policy proposals would create two tax credits—a family unit credit and a work credit—by combining several work- and family-related tax provisions, such as the standard deduction, personal exemptions, the EITC, and the CTC. The family credit would combine the standard deduction, personal exemptions, head of household filing condition, and the nonrefundable part of the CTC. The work credit would be based on earnings. This proposal would simplify the tax code by combining overlapping provisions that have dissimilar rules. Furthermore, the tax benefits would not depend on a taxpayer's taxation bracket. Since the ii credits would be available to all taxpayers with no phase out, any work disincentive would be avoided.

Others would brand adjustments to EITC parameters to make the credit more neutral with respect to marital status and number of children. Many of the proposals tinker with the phase-in range, the credit rate, and the stage-out range to reduce the penalty on workers as they earn higher wages (though as previously noted, the high marginal tax charge per unit in the phase-out range does not appear to produce a work disincentive). Increasing the starting bespeak of the stage out could also reduce any negative labor supply furnishings that may exist. Other proposals suggest adding benefits for each additional kid, in order to reduce poverty for larger families (currently a limit exists on the number of children a family can do good from through these credits). Finally, in that location are proposals to expand benefits for childless workers, who nether electric current police force are the sole group that the federal tax system taxes deeper into poverty. These reforms include lowering the eligibility age for childless workers, raising the maximum credit and the phase-in rate, and raising the earnings level at which the credit is fully phased in. This would first the payroll taxes paid by the lowest-income childless workers and improve the EITC's work incentive.14

Many unlike proposals exist for reforming and improving both the EITC and the CTC. What follows is a look at some of those reforms, in chronological society.

Ruby and Sawicky (2000)

Ruddy and Sawicky (2000) suggest a number of reforms to the EITC to accost some of the bug that accept dogged the EITC over its lifetime, such equally its loftier implicit marginal revenue enhancement rate in the phase-out range, the possibility of a union punishment, and finally, its complication.15 The authors suggest:

- targeting both issues of the marriage penalty and the college rates by lengthening the phase-out range

- creating a union bonus by both extending the phase-in range and adding benefits for additional children

- simplifying the application for the EITC past merging the definitions of qualifying income and what constitutes a filing unit with the definitions used past the IRS for income taxation filing

In addition to these specific ideas for improving the EITC, Cherry and Sawicky propose creating a "Universal Unified Kid Credit" to address the inequities and inconsistencies in the EITC and other benefits offered to families. This unified credit would combine the EITC, the CTC, and an Additional Kid Credit, and would exist available to all taxpayers with children and earned income, thus considerably increasing the eligibility for the credit. This credit would rising for an initial range of earnings, flatten out over some other range, but never phase down to zero, with a minimum benefit of $i,270 per child.16

The President's Advisory Console on Tax Reform (2005)

In 2005, President Bush created an informational console to recommend options to simplify the revenue enhancement code, as well as brand it fairer and more conducive to economical growth. The console proposed a sweeping consolidation of tax credits, combining the standard deduction, personal exemptions, child taxation credit, an boosted kid tax credit, 10 percent bracket, and the EITC into a piece of work credit and a family unit credit (President's Informational Console on Taxation Reform 2005). The family unit credit available to workers would be $iii,300 for married couples, $two,800 for unmarried taxpayers with children, $1,650 for unmarried taxpayers, and an $one,150 credit for dependent workers, a $1,500 credit for each additional kid, and a $500 credit for each additional dependent. The EITC would be replaced with a work credit, the maximum corporeality of which would exist $3,570 for a working family with one kid and $5,800 for a working family with two or more children. The purpose of consolidating the existing exemptions and credits into a family credit and a work credit was to replicate—but not better upon—the existing distribution of revenue enhancement burdens while greatly simplifying the revenue enhancement construction and improving the compliance of refundable credits.

Jason Furman, Center on Upkeep and Policy Priorities (2006)

Jason Furman (2006) as well looked into issues surrounding the EITC, ultimately using the suggestions of the President'south Advisory Panel every bit a base for his reform ideas. Get-go, nonetheless, he noted the benefits of increasing the EITC for families with iii or more children—a policy that currently exists though is scheduled to expire in 2017. Furman noted that expanding the EITC for families with at least iii children would be a well-targeted policy that would benefit almost iii one thousand thousand families, and stated that these families are among those most likely to be in poverty.

Furman would also aggrandize the EITC for childless workers, doubling the credit to encompass all payroll taxes and allowing information technology on earnings up to $8,080 (the same threshold for families with one kid). His reform would begin the phase out at $10,000 for singles and $10,000 plus a marriage adjustment for couples. The wedlock aligning would aid reduce the EITC marriage penalty, and it would exercise so by increasing the starting point for the phase-out of the EITC for married couples past $three,000. He calculated (in 2006) that commencement this policy in tax year 2008 would accept reduced the matrimony punishment by $632 for a family unit in the stage-out range, and would take provided a tax cutting of about $400 to roughly iii million married couples, at a total cost of about $1.2 billion annually.

Additionally, Furman discusses an alternative arroyo to reforming the EITC: the consolidation of existing child taxation benefits into i unified credit, much similar what both Cherry and Sawicky (2000) and the President'due south Advisory Panel on Tax Reform (2005) suggest. He suggests edifice on the Advisory Console'due south recommendations while incorporating the expansions previously discussed and also maintaining the distinction between the standard deduction and itemized deductions. Specifically, Furman proposes eliminating the dependent exemption and replacing it with a child tax credit of $i,500; that credit would be phased out for married couples starting at $200,000. The kid tax credit would be refundable up to 34 per centum of earnings for someone with 1 child, and upwardly to l percent of earnings for someone with three or more children. He suggests that a separate work credit would exist based on this framework, and include a childless EITC. Finally, he calculates that the implementation of such a framework would reduce revenues by less than $10 billion annually relative to current law, while including more incentives to piece of work, reducing the marriage penalty, and reducing poverty for larger families.

The National Committee on Financial Responsibility and Reform (2010)

In 2010, President Obama created the bipartisan National Commission on Fiscal Responsibility and Reform to address the nation's perceived fiscal challenges. While the Financial Commission did not propose reforms to the EITC or the CTC, its plan is notable for leaving in identify those policies while reforming or zeroing out other parts of the tax code that provide benefits to taxpayers (largely known as tax expenditures). In fact, the plan calls for a "smaller" and "more targeted" tax lawmaking in terms of revenue enhancement expenditures, yet insists that any new or reformed revenue enhancement code include support for depression-income workers and families on the scale of the EITC and CTC currently in identify.

The Bipartisan Policy Center Debt Reduction Task Force (2010)

The Bipartisan Policy Center Debt Reduction Job Force restructured provisions benefiting low-income taxpayers and families with children in its 2010 report, Restoring America'south Future. The task strength'due south goals were to simplify and make more progressive provisions benefiting low-income taxpayers, while also reducing complexity in the tax-filing process. The written report cites a number of reasons to do so bated from simplicity, including that the EITC tin can both create a marriage penalization and can discourage piece of work among those with incomes in the phase-out range.

The task force proposed replacing low-income tax provisions (including the Personal Exemption for Children, the Kid Tax Credit, the Earned Income Tax Credit, and the Child and Dependent Care Credit) with ii separate provisions: a universal child credit and an earnings credit. The universal kid credit would provide $1,600 per child, indexed to changes in the Consumer Toll Index. Taxpayers would file for the credit with each additional child; thereafter, receipt of the credit would be automatic until the children reach adulthood, every bit long equally they reside in the household and attend school. The earnings credit would be provided to working individuals through automatic adjustments made to withholding (workers with one chore would need to make no subsequent adjustments upon filing a tax return). The credit would not phase out; as the Bipartisan Policy Center argues, this would avert the marriage penalty and the work disincentive.

The child credit and earnings credit would compensate families for both the loss of the credits that currently exist, as well equally the impact of the "debt reduction sales tax" that they propose. Over 2012–2020, the Bipartisan Policy Centre estimated that restructuring these benefits and eliminating the standard deduction and personal exemptions would cost $ane.ix trillion, which would be offset by the vi.5 percent "debt reduction sales revenue enhancement" that would raise more $three trillion over the same time menstruation.

Economical Policy Institute (2012)

In Investing for America'southward Economy: A Budget Blueprint for Economic Recovery (2012), EPI proposes reforms to tax credits that are modeled on the Bipartisan Policy Heart's plan, described previously (Bivens et al. 2012a). EPI's plan would simplify the tax code for low-income filers, promote upward mobility past reducing the high constructive marginal tax rates faced by many families as the credits phase out, and besides do good the economy through providing high "bang-per-buck" for each dollar spent on these credits (Zandi 2011).

The EPI proposal argues for creation of work and family credits to take the place of the personal exemption and standard deduction, as well as the electric current EITC, CTC, and Child and Dependent Care Credit (CDCC). In their place, EPI proposes implementing both a work credit and a family credit. The work credit would exist set at 30 percent on the first $20,300 of income per worker. This credit would not phase out at any income level and is designed to be fully refundable. The accompanying child credit is structured to provide a refundable tax credit of $one,600 per dependent child under historic period eighteen, with a limit of three per household. Over financial 2013–2022, this policy is scored equally costing $6.65 trillion (Bivens et al. 2012b).17

The Working Families Tax Relief Human activity of 2013 (Due south. 836) and the Earned Income Taxation Credit Improvement and Simplification Act of 2013 (H.R. 2116)

Both the Working Families Tax Relief Act of 2013 (S. 836) and the Earned Income Tax Credit Comeback and Simplification Human action of 2013 (H.R. 2116) would piece of work to strengthen the EITC for childless workers.eighteen They would do then by lowering the eligibility age to 21 (it currently stands at 25), phasing in the credit more rapidly, and raising the maximum credit to $1,350.

The boilerplate credit for eligible childless workers between ages 25 and 64 is currently $270, roughly i-tenth of the average credit for filers who are raising children. Additionally, the phase out for childless workers currently begins when earnings exceed $7,970—just 55 percent of earnings for a full-fourth dimension, minimum-wage earner (Marr, Ruffini, and Huang 2013).

By both boosting the credit and easing the eligibility requirements for childless workers, these reforms would take advantage of the EITC's proven benefits of promoting work and alleviating poverty. A recent Heart on Budget and Policy Priorities study (Marr, Ruffini, and Huang 2013) estimates that such a reform package, as put forward in these bills, would lift more than 300,000 childless workers out of poverty, and significantly reduce the severity of poverty for almost four million more workers. Furthermore, such an expanded credit could help meet challenges faced especially by younger, less-educated people. These include low labor force participation rates, low marriage rates, and even high incarceration rates.

While H.R. 2116 would only extend the new benefits to those who are not students, the bills are similar in that they would lower the eligibility age for childless workers, raise the earnings level at which the credit is fully phased in from $6,370 to $8,820, and would raise the income level for the beginning of the credit phase out from $7,970 to $ten,425 (Marr, Ruffini, and Huang 2013). Additionally, the credit would stage downwardly at a fifteen.three percent charge per unit and phase out entirely at $19,245 (133 percent of total-fourth dimension earnings at minimum wage).

S. 836 would also brand the $iii,000 income threshold for the CTC permanent, eliminate the indexing of the threshold, and index the value of the maximum credit.

— The authors would like to give thanks David Harris, Monique Morrissey, and Maxim Shevdov for comments on a previous draft. Funding from the Peter 1000. Peterson Foundation is gratefully best-selling.

About the authors

Thomas L. Hungerford joined the Economic Policy Institute in 2013. Prior to joining EPI, Hungerford worked at the General Accounting Role, the Office of Direction and Budget, the Social Security Administration, and the Congressional Inquiry Service. He has published research manufactures in journals such as theReview of Economics and Statistics,Journal of International Economics,Journal of Human Resources,Journal of Urban Economics,Review of Income and Wealth,Periodical of Policy Assay and Management,Challenge, andTax Notes. He has taught economics at Wayne State Academy, American University, and Johns Hopkins Academy. He has a Ph.D. in economic science from the University of Michigan.

Rebecca Thiess joined the Economic Policy Constitute in 2010 as a federal budget policy analyst. Her areas of research include federal upkeep and revenue enhancement policy, retirement security, and public investment. She has a master'southward degree in public policy from Duke University and a B.A. in urban and environmental policy from Occidental College.

Endnotes

one. See Cook (2013) for a media study well-nigh these recent attacks.

2. Taxation expenditures are defined in the Congressional Budget and Impoundment Control Human action of 1974 every bit "those revenue losses owing to provisions of the Federal revenue enhancement laws which let a special exclusion, exemption, or deduction from gross income or which provide a special credit, a preferential rate of revenue enhancement, or a deferral of taxation liability."

three. If the taxation credit were non refundable, then this taxpayer'south tax liability would exist reduced to nada, and he would receive no tax refund.

4. The Family unit Assistance Plan was a negative income revenue enhancement for families and would have replaced the welfare arrangement, which primarily was Help to Families with Dependent Children (AFDC). Only families with unmarried children under age 18 (age 21 if in school) would have been eligible for the benefit (a maximum of $ane,600 for a family unit of four). See Lampman (1969) for a discussion of FAP.

v. Sen. Long wanted a work-oriented tax programme to move welfare recipients into paid employment, and the NWRO wanted a higher income floor. The NWRO used the slogan "zap FAP."

six. Personal exemptions are phased out every bit income rises for taxpayers with income over $200,000 (single) or $250,000 (married).

7. Single taxpayers or married taxpayers with no dependents claiming the EITC may file Form 1040EZ.

eight. In comparing, Form 1040 in 1945 was a single-folio, nine-line form for most taxpayers. The pedagogy booklet was four pages.

9. The substitution effect of a toll alter is the modify in demand for the practiced when relative prices modify, holding utility constant (i.east., assuming income is adapted so as to maintain the consumer's pre–cost change utility). See, for case, Deaton and Muellbauer (1980).

ten. The income event is the change in demand for the proficient allowing for the change in utility due to the income change, property relative prices at the new level.

11. It is often difficult to determine who is the primary wage earner and who is the secondary wage earner in a dual-worker household.

12. State taxes are ignored, but employees' share of payroll taxes is included. Income from public ways-tested transfers is non considered in the analysis. The poverty thresholds used are the weighted boilerplate thresholds computed past the Census Agency; these thresholds reflect family size but non composition. Taxpayers who tin can be claimed equally a dependent on another's tax return are excluded from the analysis.

13. While the poverty rate is reduced, the poverty gap (the gap between the poverty threshold and income) for some of those remaining in poverty really increases.

14. Yin and Forman (1993) suggest eliminating the EITC and introducing an exemption from the employee portion of payroll taxes. This would apply to all workers (thus benefiting childless workers to the aforementioned extent as workers with children), would eliminate the high marginal revenue enhancement rate associated with the EITC phase out, and would eliminate the complexity of the electric current EITC. However, payroll revenue enhancement revenues to the Social Security and Medicare trust funds would be reduced.

15. Since their newspaper was published, the EITC has been modified. The Economic Growth and Tax Relief Reconciliation Act (EGTRRA) of 2001 raised the income level at which the credit begins to stage out for couples to $3,000, and the American Recovery and Reinvestment Deed (ARRA) increased that amount to $five,000 (and indexed it to inflation). The Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 extended the provisions passed nether ARRA through 2012, and the American Taxpayer Relief Act of 2012 extended those provisions once more through 2017, and besides made permanent the increase passed under EGTRRA (Taxation Policy Center 2013).

16. At the fourth dimension of the proposal, this was the tax benefit of the exemption and CTC for taxpayers in the 28 pct bracket.

17. This score was provided to the Economic Policy Institute from the Tax Policy Heart in its analysis of EPI's policy proposals submitted for the Peterson Foundation'southward Fiscal Solutions Initiative Two. This score includes the elimination of the standard deduction, personal exemption, EITC, CTC, CDCC, child care exclusion, and educational activity preferences.

18. A unmarried and childless full-time worker earning the minimum wage is ineligible to receive the EITC due to the fact that his or her earnings exceed the income limit for the credit provided to workers without children.

References

Bipartisan Policy Heart. 2010. Restoring America's Future (report of The Debt Reduction Task Force co-chaired past Sen. Pete Domenici and Dr. Alice Rivlin). http://goo.gl/HucSKH

Bivens, Josh, Andrew Fieldhouse, Ethan Pollack, and Rebecca Thiess. 2012a. Investing in America's Economy: A Budget Design for Economic Recovery. Economic Policy Establish. http://www.epi.org/files/2012/investing-americas-economy-budget-blueprint.pdf

Bivens, Josh, Andrew Fieldhouse, Ethan Pollack, and Rebecca Thiess. 2012b. Summary Tables and Figures (as adapted for the Peter 1000. Peterson Foundation's 2012 Fiscal Solutions Initiative). Economic Policy Constitute. http://www.epi.org/files/2012/EPI%20Blueprint%20Tables.pdf

Cherry, Robert, and Max Sawicky. 2000. Giving Taxation Credit Where Credit Is Due—A 'Universal Unified Child Credit' that Expands the EITC and Cuts Taxes for Working Families. Economic Policy Establish. http://www.epi.org/publication/briefingpapers_eitc/

Chetty, Raj, John North. Friedman, and Emmanuel Saez. Forthcoming. "Using Differences in Cognition Across Neighborhoods to Uncover the Impacts of the EITC on Earnings." American Economic Review.

Cook, Nancy. 2013. "The 51 Percent." National Journal, May 29. http://www/nationaljournal.com/magazine/the-51-percent-20120209

Cronin, Julie-Anne, Portia DeFilippes, and Emily Y. Lin. 2012. "Effects of Adjusting Distribution Tables for Family Size." National Revenue enhancement Journal, vol. 65, no. four, 739–758.

Electric current Population Survey basic monthly microdata. Various years. Survey conducted by the Bureau of the Census for the Bureau of Labor Statistics [machine-readable microdata file]. Washington, D.C.: U.South. Census Bureau. http://www.bls.census.gov/cps_ftp.html#cpsbasic

Deaton, Angus, and John Muellbauer. 1980. Economics and Consumer Behavior. Cambridge: Cambridge University Printing.

Eissa, Nada, and Hilary Due west. Hoynes. 2006a. "Behavioral Responses to Taxes: Lessons from the EITC and Labor Supply." In Tax Policy and the Economy, Volume 20, edited by James M. Poterba. Cambridge, Mass.: MIT Printing.

Eissa, Aught, and Hilary W. Hoynes. 2006b. "The Hours of Piece of work Response of Married Couples: Taxes and the Earned Income Taxation Credit." In Taxation Policy and Labor Market Performance, edited by Jonas Agell and Peter Birch Sorensen. Cambridge, Mass.: MIT Press.

Furman, Jason. 2006. Taxation Reform and Poverty. Middle on Budget and Policy Priorities. http://www.cbpp.org/cms/alphabetize.cfm?fa=view&id=134.

Gravelle, Jane, and Jennifer Gravelle. 2006. "Horizontal Equity and Family unit Tax Treatment: The Orphan Kid of Tax Policy." National Tax Periodical, vol. 59, no. 3, 631–649.

Heim, Bradley T. 2010. The Impact of the Earned Income Revenue enhancement Credit on the Labor Supply of Married Couples: A Structural Estimation. Indiana Academy working newspaper.

Hoffman, Saul D., and Lawrence S. Seidman. 1990. The Earned Income Tax Credit: Antipoverty Effectiveness and Labor Market Effects. Kalamazoo, Mich.: W.East. Upjohn Establish.

Hotz, Five. Joseph, and John Karl Scholz. 2003. "The Earned Income Taxation Credit." In Means-Tested Transfer Programs in the U.S., edited by Robert Moffitt. Chicago: University of Chicago Press.

Hungerford, Thomas L. 2006. "Tax Expenditures: Good, Bad, or Ugly?" Tax Notes, vol. 113, no. iv, 325–334.

Hungerford, Thomas L. 2010. "The Redistributive Effect of Selected Federal Transfer and Revenue enhancement Provisions." Public Finance Review, vol. 38, no. 4, 450–472.

Internal Revenue Service (IRS). 2002. "Compliance Estimates for Earned Income Tax Credit Claimed on 1999 Returns." http://www.irs.gov/pub/irs-utl/1999_compliance_study_022802.pdf

Internal Revenue Service (IRS). 2008. "Statistics of Income Public Employ File" [information tables].

Internal Revenue Service (IRS). 2011. "Revenue Procedure 2011-52." http://www.irs.gov/pub/irs-drop/rp-11-52.pdf

Internal Revenue Service (IRS). 2012. "2010 Estimated Data Line Counts, Individual Income Tax Returns, Rev. 11-2012." http://world wide web.irs.gov/pub/irs-soi/10inlinecount.pdf

Internal Revenue Service (IRS). 2013. "Revenue enhancement Year 2012 Kid-Related Tax Benefits Comparing." http://www.eitc.irs.gov/public/site_files/crtbcchartv5.doctor.

Joint Committee on Tax. 1997. General Caption of Tax Legislation Enacted in 1997.

Joint Committee on Taxation. 2013. Estimates of Federal Tax Expenditures for Financial Years 2012-2017 (JCS-1-13).

Lampman, Robert J. 1969. Nixon's Family Assist Plan. University of Wisconsin, Institute for Research on Poverty, Give-and-take Newspaper 57-69.

Marr, Chuck, Krista Ruffini, and Chye-Ching Huang. 2013. Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty. Center on Budget and Policy Priorities. http://www.cbpp.org/cms/?fa=view&id=3991

McCubbin, Janet. 2000. "EITC Noncompliance: The Determinants of the Misreporting of Children." National Tax Journal, vol. 53, no. 4, 1135–1164.

Meyer, Bruce D. 2010. "The Effects of the Earned Income Tax Credit and Recent Reform." In Tax Policy and the Economy, Volume 24, edited by Jeffrey R. Brownish. Chicago: Academy of Chicago Printing.

National Agency of Economic Research. Various years.TAXSIM Related Files at the NBER[database]. http://users.nber.org/~taxsim/

National Commission on Children. 1991. Beyond Rhetoric: A New American Calendar for Children and Families.

National Commission on Fiscal Responsibleness and Reform. 2010. The Moment of Truth: Study of the National Commission on Fiscal Responsibility and Reform. http://world wide web.fiscalcommission.gov/news/moment-truth-study-national-commission-fiscal-responsibility-and-reform.

President'southward Advisory Panel on Tax Reform. 2005. Simple, Fair, and Pro-Growth: Proposals to Fix America'due south Tax Arrangement. http://www.treasury.gov/resource-center/tax-policy/Documents/Simple-Fair-and-Pro-Growth-Proposals-to-Gear up-Americas-Taxation-Arrangement-xi-2005.pdf

Sandmeyer, Ellie. 2013. "Play a joke on Business Host Admits He'southward 'Being Mean to Poor People.'" Media Matters blog, June 5. http://mediamatters.org/blog/2013/06/05/fox-business-host-admits-hes-beingness-hateful-to-poor/194360

Smith, Adam. 1776. The Wealth of Nations (1937 Cannan edition). New York: The Modern Library.

Snyder, Brad. 1995. "GOP Is Cutting Tax Credit for Poor Begun by Nixon, Expanded by Reagan." Baltimore Sun, Oct 27. http://articles.baltimoresun.com/1995-ten-27/news/1995300027_1_earned-income-tax-enhance-taxes-credit-for-poor

Steuerle, C. Eugene. 2004. Contemporary U.S. Tax Policy. Washington, D.C.: Urban Establish Printing.

Tax Policy Center. 2013. "Revenue enhancement and the Family unit: What Is the Earned Income Tax Credit?" In The Tax Policy Briefing Book. Urban Establish and Brookings Establishment. http://www.taxpolicycenter.org/briefing-book/key-elements/family/eitc.cfm

Toder, Eric, and Daniel Baneman. 2012. Distributional Effects of Individual Income Taxation Expenditures: An Update. Urban-Brookings Tax Policy Centre. http://www.urban.org/UploadedPDF/412495-Distribution-of-Tax-Expenditures.pdf

Treasury Inspector General for Tax Assistants (U.S. Department of the Treasury). 2013. "The Internal Revenue Service Was Not in Compliance With All Requirements of the Improper Payments Elimination and Recovery Act for Financial Year 2012" (reference number 2013-40-024).

Ventry, Dennis J. 2000. "The Collision of Tax and Welfare Politics: The Political History of the Earned Income Tax Credit, 1969-99." National Tax Periodical, vol. 53, no. four, 983–1026.

Yin, George K., and Jonathan Barry Forman. 1993. "Redesigning the Earned Income Tax Credit Program to Provide More than Constructive Assistance for the Working Poor." Tax Notes, May 17, 951–960.

Zandi, Mark. 2011. An Assay of the Obama Jobs Plan. The Dismal Scientist, Moody's Analytics. September 9. http://www.economy.com/dismal/article_free.asp?cid=224641

Source: https://www.epi.org/publication/ib370-earned-income-tax-credit-and-the-child-tax-credit-history-purpose-goals-and-effectiveness/

Post a Comment for "A Provision of the Federal Tax Code Reducing the Taxes for Low-income Families With Job Earnings."